Seller closing costs on Long Beach Island

Understanding the full picture of your closing costs is essential if you are thinking of selling your home in Long Beach Island. These expenses can affect your bottom line, so having a clear breakdown upfront can help you plan more confidently.

Full breakdown

Real Estate Commission

Typically 4%–5% of the sale price, split between the buyer’s and listing agent.

New Jersey Transfer Tax

A tiered state tax based on the final sale price of the home, due at closing.

Attorney Fees

Roughly $1,200–$2,000 for a qualified NJ real estate attorney to handle your side of the transaction.

Payoff of Existing Mortgage(s)

Includes any fees to record the release of the lien and finalize your loan payoff.

Certificate of Occupancy (CO)

Required by each local municipality. Inspections typically cost $50, with a $25 re-inspection fee if needed.

If smoke detectors or fire extinguishers need to be installed, expect an additional cost of around $200.

Out-of-State Residency Tax

If you live outside New Jersey, the state charges a 2% tax on the total sale price, due at closing.

Mansion Tax (Effective 2025)

Applies to homes sold for over $1 million, based on a tiered system:

$1,000,000.01 to $2,000,000.00: 1.0%

$2,000,000.01 to $2,500,000.00: 2.0%

$2,500,000.01 to $3,000,000.00: 2.5%

$3,000,000.01 to $3,500,000.00: 3.0%

$3,500,000.01 and over: 3.5%

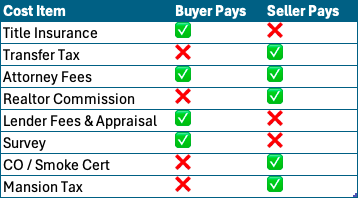

Who Pays What?

Here’s a simplified breakdown: