Long Beach Island November real estate market recap

Holgate Christmas tree lighting

November LBI Real Estate Market Update

The LBI real estate market stayed active through November even as the island shifted into its usual late fall rhythm. This time of year usually slows down as people focus on the holidays, but tight inventory and steady demand kept the market moving. November brought low supply, strong prices, cash heavy activity, and continued interest in new construction across the island.

Here is a look at what happened and what it means if you are planning a purchase or sale on Long Beach Island.

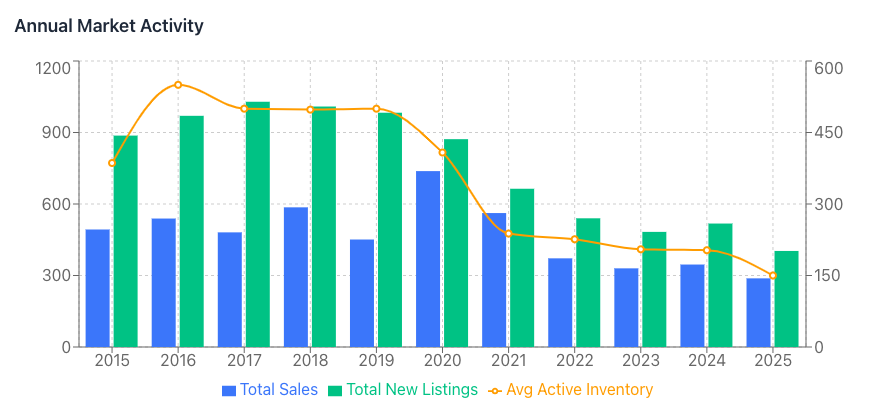

New Listings and Sales Activity

November brought 30 new listings, which is extremely low for this time of year. Only 9 homes went under contract and 28 sales closed.

Harvey Cedars had the standout sale of the month with a 4M boulevard property built in 2023. Even though it was on the Blvd, it was a high end build and drew strong demand.

Home Prices on LBI in November

Prices climbed compared to last year.

The median closed price for November came in at 2,495,000, up from 1,775,000 last November. This jump reflects the tight supply, new construction activity, and higher end properties trading hands.

The average price/psf landed at $1,162,000. Five new construction homes sold between 2.9M and 4M, and there were also five tear down properties that helped balance out the numbers. New construction continues to shape the upper end of the market while tear downs remain attractive for buyers planning a build.

Inventory Remains Extremely Tight

Active inventory ended November at 86 single family homes, compared to 214 this time last year. This is the lowest level you have seen since 2015, and it is putting real upward pressure on prices. Supply and demand is playing out in real time.

With so few homes available, sellers are split on strategy. Some are pricing aggressively because they know inventory is tight. Others are pricing slightly under market value to attract multiple offers. That strategy worked at least once this month, since November had one bidding war.

Buyer Activity and Negotiation Trends

Buyer behavior depended mostly on price. Homes that lingered past 30 days saw more negotiation from buyers. Well priced homes still moved, especially if they were newer builds or located close to the ocean.

Cash activity remained strong. More than half of all November transactions were cash, which is common on LBI but still a sign of confidence in the market.

Days on Market

Homes that sold in November averaged 65 days on market. That is close to last year’s pace of 64 and faster than the 79 day average from 2025. Even with low inventory, buyers are taking their time on certain listings, but well presented properties are still attracting attention.

What Buyers Are Asking About Now

• The new mansion tax and how it affects pricing

• The REAL initiative and how it could impact future building options, especially if base flood elevations are increased

There is also a continued preference for newer homes. The last five new construction sales closed above 97 percent of their list price. That level of demand has not slowed.

As for location preferences, people are still paying a premium to be closer to the ocean. Bayside properties with boat access remain popular, but the ocean side continues to command the highest attention and strongest pricing.

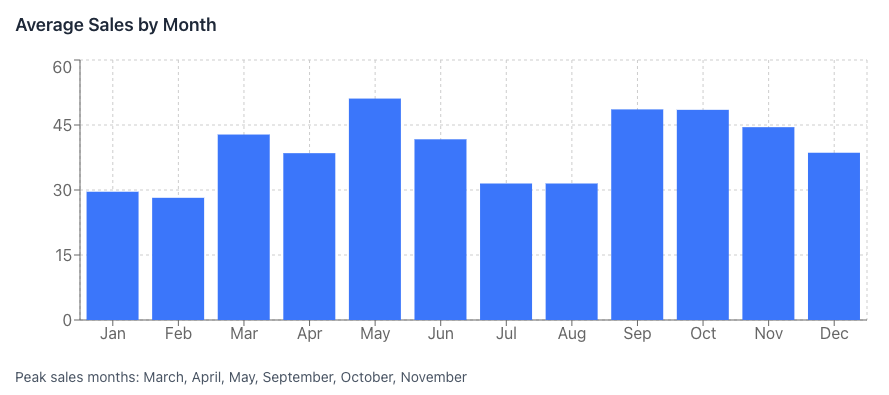

Seasonal Patterns and What to Expect Next

November usually marks the start of the slower season as attention turns to the holidays, and this year followed that pattern. Activity tends to pick up again in late February.

Should You Buy or Sell Right Now

For buyers:

If you want something specific, this winter is a good time to start looking because inventory is so low. When new homes hit the market, they stand out quickly, and buyers who are prepared will be in the best position.

For sellers:

Typically I would suggest waiting for the spring market to list your home as December is usually a slow listing month, but the lack of inventory changes the dynamic. A well presented home can still get attention right now since buyers have very few options to choose from.

My Takeaway on the November LBI Market

This November was defined by low supply, steady demand, strong pricing, and ongoing interest in new construction. Cash buyers remain active and conversations are shifting toward long term building rules, flood elevations, and tax changes. Buyers are still prioritizing locations on the oceanside or oceanblock, and well priced listings continue to move.

If you are thinking about buying, selling, or building on LBI and want a clearer picture of what this means for your plans, I can help you break down the numbers and identify the best opportunities.

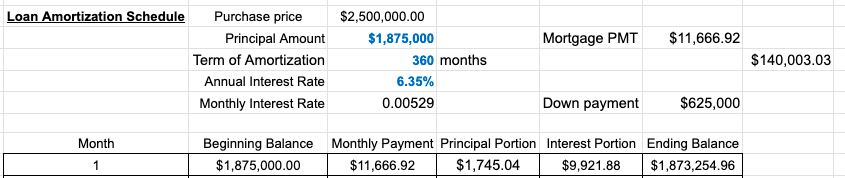

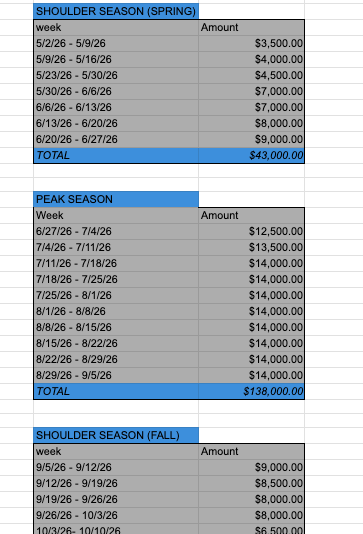

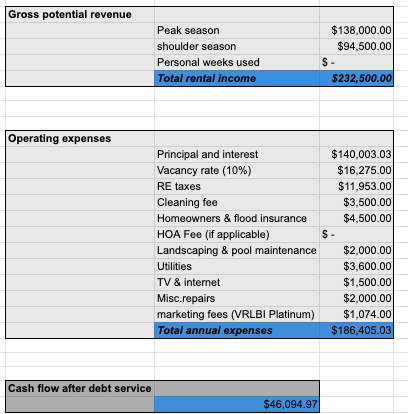

I also have access to off market construction projects and can help you analyze short term rental income for any property you are considering.

If you want a full set of November comps or a personalized breakdown of the market, reach out anytime.

I have spent the last seven years analyzing rental properties and I also earned a business degree with a concentration in real estate from Monmouth University. When you are evaluating investment opportunities it is crucial to work with someone who understands every expense and has a long track record of running these numbers accurately.

If you want me to run the numbers on a property or would like a copy of my spreadsheet just send me a message. Below is an example of my rental pro forma.