2025 Tax Breaks That Benefit LBI Buyers and Investors

How Bonus Depreciation and the New SALT Rules Can Put Tens of Thousands Back in Your Pocket

Buying or investing on Long Beach Island continues to offer strong long term upside. What most buyers and investors do not realize is that the tax code has become even more favorable in 2025. These changes affect income producing properties, including second homes and short term rentals, which means many LBI buyers can reduce their tax bill from day one.

This guide breaks down the two tax benefits that matter most to LBI buyers: bonus depreciation and SALT deductibility, how they apply specifically to LBI properties, who qualifies, and realistic examples of potential savings.

As someone who has spent the last 25 years on Long Beach Island and worked in the community since 2016, I manage dozens of rental property owners across the entire island and help them understand how these updates impact real numbers.

Why LBI Buyers Should Pay Attention to 2025 Tax Changes

LBI has a unique mix of high-value homes, strong rental demand, and older housing stock. This makes the island a prime candidate for tax strategies that reward improvements, renovations, and income-producing properties.

The two most important updates for 2025 are:

Return of 100% bonus depreciation for qualifying property

Expanded SALT deduction cap to $40,000 per year per taxpayer

More flexibility for short-term rental owners who materially participate

These rules can significantly reduce taxable income for investors who rent their homes or make upgrades, improving cash flow and the overall return on investment.

The Most Valuable 2025 Tax Breaks for LBI Buyers

Bonus Depreciation Returning to Higher Levels

One of the biggest changes in 2025 is the increase in bonus depreciation. Investors can now deduct a larger share of the cost of qualifying property in year one. This includes improvements such as:

What Qualifies on LBI

Renovations to older Cape Cod or cottage-style homes

Additions and major system upgrades

Decking and outdoor living improvements

Bulkhead and dock work on lagoon or bayfront homes

Furniture packages for rentals

Appliances and equipment

Technical Note:

As MVO Cost Segregation explains, “Bonus depreciation does not create more overall depreciation. Instead it further accelerates the depreciation that can be deducted in year one.”

Interpretation:

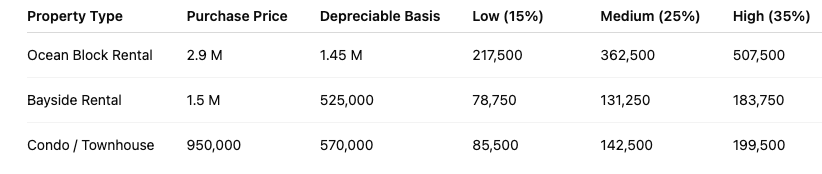

Even at the low end, investors with high-value homes can achieve six-figure deductions in year one. Smaller properties still benefit meaningfully, making bonus depreciation a powerful tool for LBI rental property owners.

Short Term Rental Owners Have More Flexibility in 2025

LBI investors who rent their homes for part of the year can now offset other income if they meet material participation standards. To qualify, owners typically:

Self-manage their rental

Handle bookings and inquiries

Respond to guests directly

Coordinate repairs and cleaning

This makes it possible for some owners to apply bonus depreciation against higher W2 or investment income, increasing after-tax cash flow.

SALT Deduction Changes and Why They Matter

Property taxes on Long Beach Island are lower than many high-tax areas like New York or northern New Jersey due to fewer infrastructure costs and high property values.

Under the 2025 federal tax rules, the SALT deduction cap is increased to $40,000 per taxpayer per year (joint filers may combine for $80,000). This is a major increase from the previous $10,000 limit.

Phase-out thresholds:

The cap begins to phase out for taxpayers with Modified Adjusted Gross Income (MAGI) over approximately $500,000.

Above roughly $600,000 MAGI, the cap reverts to $10,000.

By combining SALT deductions with bonus depreciation, LBI investors can significantly reduce taxable income, particularly for seasonal rentals or waterfront properties.

What These Tax Breaks Mean for Different Types of LBI Buyers

First Time Buyers

New buyers may underestimate the impact of accelerated depreciation. If a property is rented part of the year, deductions can offset taxable income and improve cash flow.

Move Up Buyers

Owners upgrading to larger or waterfront homes can leverage bonus depreciation for renovations or furnishing, reducing the effective cost of improvements.

Investors Focused on Rental Income

The LBI short-term rental market is strong. Faster depreciation reduces payback periods for renovations and increases net cash flow.

Owners Renovating Older Homes

Many LBI homes are older. Depreciation rules support upgrades like HVAC replacement, insulation, flood mitigation, and window upgrades. These improvements now create meaningful first-year tax savings.

Example Scenarios That Apply to LBI

Renovating a Classic Cape in North Beach Haven

A buyer renovates the kitchen and bathrooms, replaces the roof, and upgrades HVAC. Many of these improvements qualify for accelerated depreciation, reducing the owner’s first-year tax bill.

Updating a Waterfront Home in Loveladies

A buyer replaces a bulkhead and dock. These capital improvements are eligible for bonus depreciation, producing substantial first-year deductions for higher-value properties.

Furnishing a New Construction Rental in Holgate

Furniture, appliances, and equipment purchased for a short-term rental can qualify for accelerated write-offs, further increasing first-year tax benefits.

Important Caveats Every Investor Should Know

Bonus depreciation applies only to qualifying improvements, not land.

Participation rules can limit deductions for passive investors.

Deductions may need to be recaptured upon sale.

Timing of “placed in service” matters for eligibility.

SALT deduction phase-outs may limit benefit for very high-income buyers.

Always consult a CPA familiar with coastal real estate and short-term rentals.

The Bottom Line for 2025

The combination of low LBI property taxes, restored SALT deductibility up to $40,000, and accelerated bonus depreciation makes 2025 an excellent year for rental property investors. Even mid-range properties can generate meaningful first-year tax savings.

If you are evaluating an LBI property, I can build a run-the-numbers model to show realistic first-year depreciation, potential rental income, and ROI. Let’s schedule a call so you can see the actual impact on your specific property.